One Door Visual Merchandising Blog

Adopt AI to Adapt: Visual Merchandising Edition

Visual merchandisers remain a crucial part of the customer experience to drive sales, even with the influx of AI. However, they need to adapt to stay ahead of the curve. AI is emerging as a powerful tool, especially when adopted as a lever to get ahead. It...

The ROI of AI for Visual Merchandisers

For visual merchandisers, AI is a necessary tool to become more strategic. This means spending less time doing manual, operational work and more time being able to make calculated design decisions that will drive revenue by better connecting customers to the brand,...

AI Use Cases for Visual Merchandisers

Visual merchandisers want to find the right AI solution, they really do. AI was once a smaller topic of conversation, but then rapidly gained momentum over the last few years. At One Door, we talk to visual merchandisers from several retail sectors struggling to...

AI Can’t Replace Human Creativity

We’re all thinking, is AI coming for my job? Short answer: No! You still need a human to drive results. It’s becoming exceptionally difficult for visual merchandisers to keep up with the constantly changing expectations of merchandising teams, from being expert...

Luxury Brands Thrive on Flawless Execution

Visual merchandisers need a streamlined process in place to ensure their displays make an impact when it comes to up-scale merchandising. Luxury brands have no choice but to deliver an amazing in-store experience to make a sale. This poses a greater challenge for...

What Does AI Mean in the Retail Space?

Artificial Intelligence (AI) has become a trendy term, promising innovation and efficiency across industries. In the retail space, where consumer behavior, market trends, and e-commerce are constantly changing, the discussion around AI is more relevant than ever....

Visual Merchandisers Deserve a Seat at the Table

Hint: It’s by adopting retail technology. Visual merchandisers are the unsung heroes responsible for crafting the in-store experience that captures customers' hearts. However, despite their best efforts, getting their innovative ideas heard by HQ execs can sometimes...

Are you Leaving Revenue on the Shelf?

Every square foot of shelf space and every display has the potential to make or break sales. In order to do this, visual merchandisers need to ensure their displays are executed correctly. However, visual merchandisers find it incredibly challenging to monitor store...

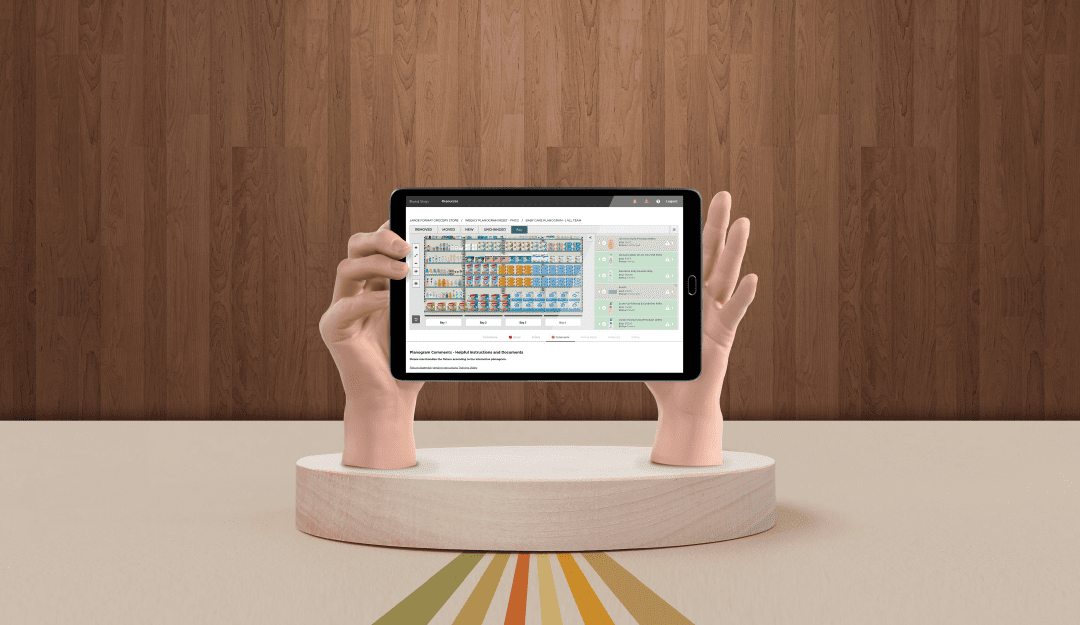

Bridging Stakeholder’s Transparency Gap

The need for clear communication, collaboration, and efficient data sharing between visual merchandising, space, and store teams is more crucial than ever. Especially with the holiday season approaching, plans are being rolled out to stores incredibly quickly. Every...

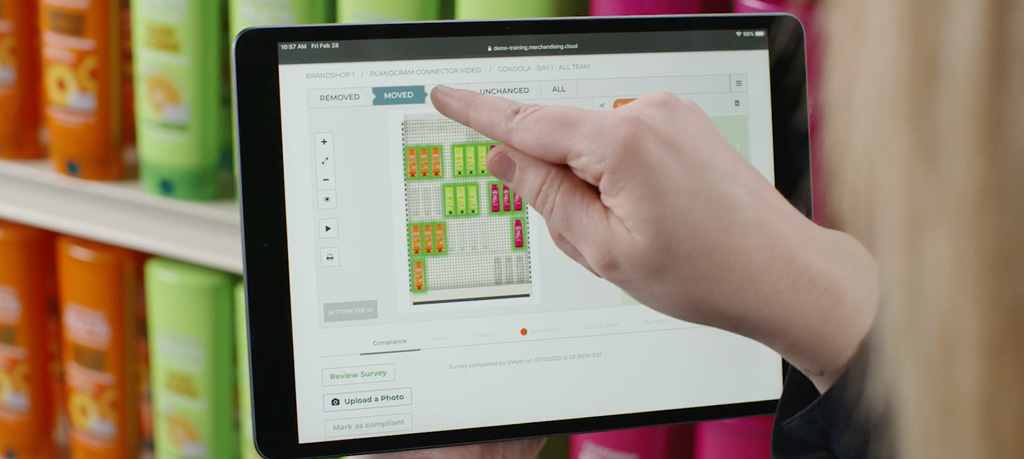

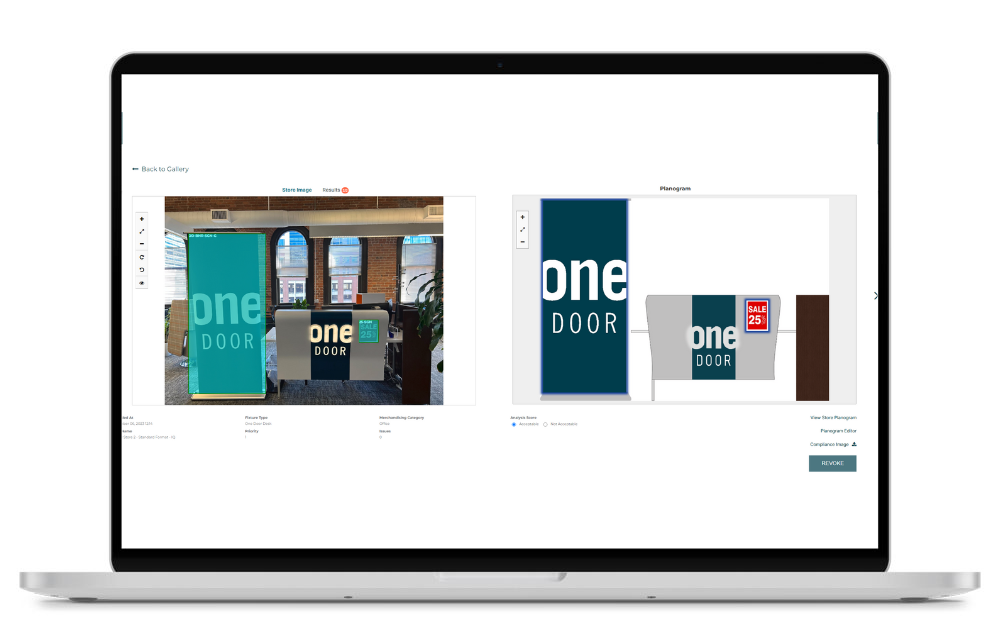

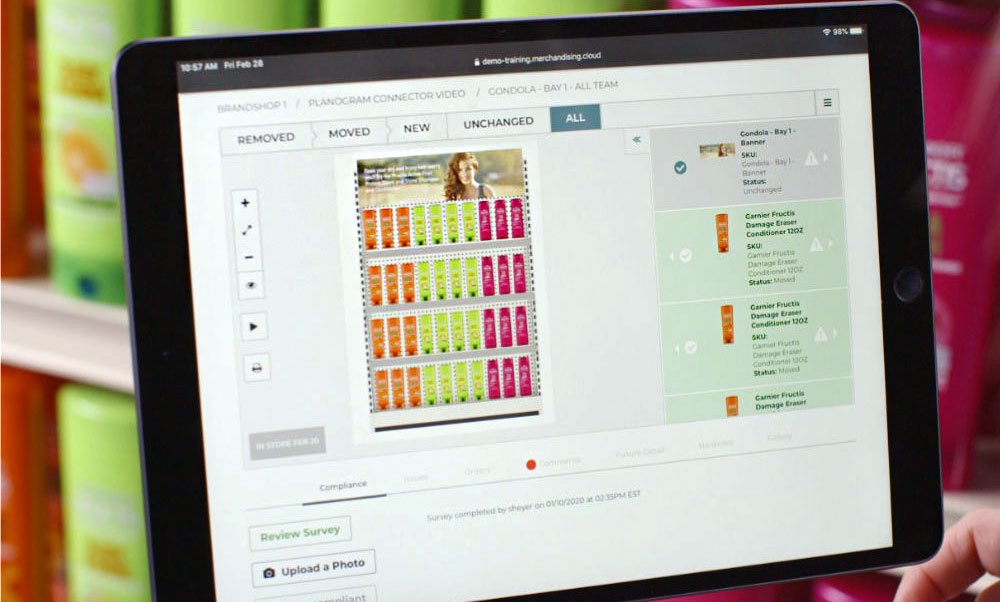

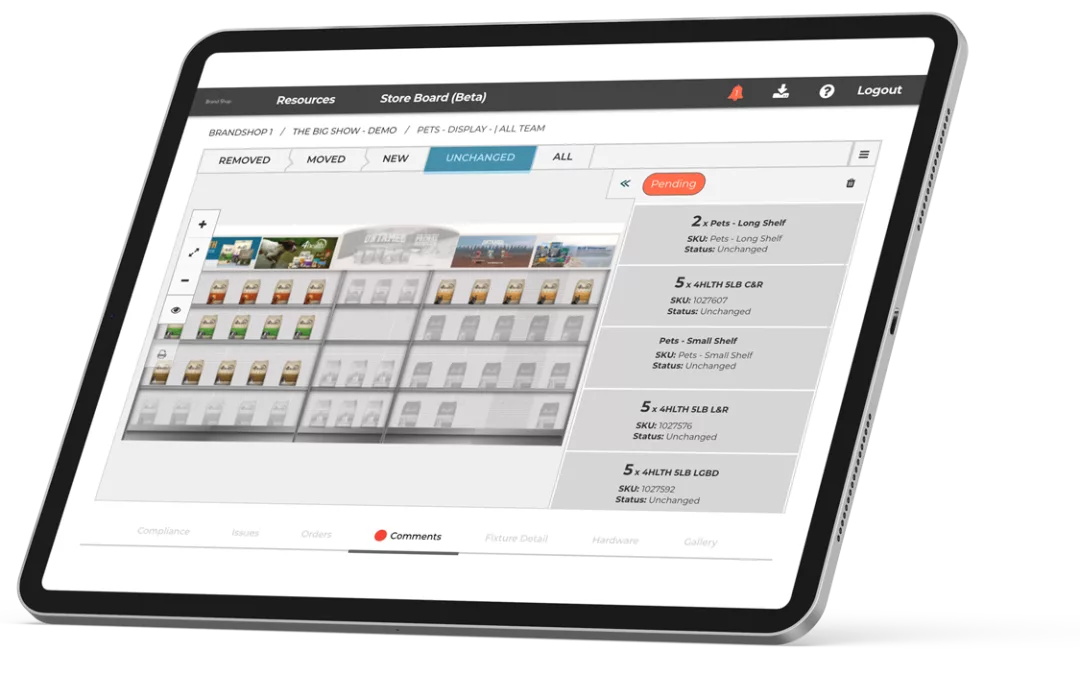

Product Spotlight: Image IQ™

The AI-powered compliance solution for visual merchandisers Visual merchandisers need to ensure that their displays are always compliant with brand standards and planograms, while also being conscious of time and money. This challenge can be difficult to overcome,...

The Importance of Transparent Data

In the visual merchandising world, achieving the perfect balance between headquarters executives, visual merchandisers, and store associates is a very challenging task. And while data plays a pivotal role in many business decisions, it’s hard to get every stakeholder...

Team Work Makes the Retail Dream Work

The synergy between HQ executives, visual merchandisers, and store operations is essential. Visual merchandisers are the center of this retail ecosystem and have to bridge the gap between strategy and execution. However, they face the daunting challenge of balancing...

Revolutionary Digitization for Localization

Staying ahead of consumer expectations is essential for retail success. According to the global news outlet Pymnts, A renowned beauty and cosmetics retailer, Ulta beauty, has managed to not only keep up but thrive in the face of digital transformation and changing...

Retail Localization at a Global Scale

While retail brands operate globally, visual merchandisers must focus on local operations to foster business growth. A significant challenge for retailers involves adapting global visual merchandising strategies to local markets, ensuring brand consistency and...

Just a Brick and Mortar Store Living in a Digital World

Omnichannel retail is a powerful strategy for retailers to combine what customers see online with how they experience shopping in-store. Omnichannel retailing is all about creating a unified and cohesive shopping journey across online, mobile, and brick-and-mortar...

Is your Planogram Stuck in the 1970s?

Visual merchandising has always had the same goal: strategically promote products, drive revenue, and create a unique store experience. However, the role and execution have drastically changed in the last 50 years. Visual merchandisers need to adapt to the...

Shaping Store Displays from Customer Analytics

Understanding the unique preferences and behaviors of local customers is crucial for creating impactful visual merchandising strategies. There is no one-size-fits-all merchandising. Data-driven insights have emerged as a game-changer, empowering visual merchandisers...

From Culture to Commerce: Creating Local Strategies with One Workflow

Recognizing and embracing diversity through localized nuances is essential for retail stores to thrive, especially in such a globalized industry. For visual merchandisers, understanding and incorporating local culture into their strategies can make a significant...

No, AI is not Taking over Visual Merchandising Jobs

Delivering personalized experiences to customers has become essential for driving revenue and creating a lasting impact. With advancements in artificial intelligence and visual merchandising technology, retailers now have the tools to empower their visual...

Using the Power of Presentation to be Customers’ Number One Choice

Customers have countless options in choosing where they want to shop. That’s where the power of personalization comes into play, and visual merchandisers have the ability to make lasting impressions on customers to drive sales and increase brand loyalty. Retail...

The Retail Tech Stack Needed for Success

The retail industry is constantly evolving, and technology is at the forefront of this innovation. From mobile apps like Shopkick and Ibotta to visual merchandising platforms like One Door, retailers are leveraging technology to create more engaging and personalized...

Leveraging Retail Technology Tools to Optimize Sustainability in Visual Merchandising

Sustainability in both environmental and operational efficiency has become a key factor for retailers to consider in their day to practice. The main driver for visual merchandisers are creating environmentally friendly stores, but also driving customers to feel good...

Leveraging Retail Analytics to Better Understand Customer Behavior

In the dynamic world of retail, staying ahead of the competition requires more than just intuition and experience. As a visual merchandiser, you play a crucial role in creating captivating in-store experiences in order to drive sales. Retail analytics plays an...

The Power of Visual Merchandising Software for In-Store Compliance

In-store compliance has a powerful impact on sales. It is one of the most effective ways to make for a meaningful customer experience and impactful revenue driver. However, it can be incredibly challenging for visual merchandisers to establish efficient processes to...

Is Brand Building the Path to Retail Success?

In today's fiercely competitive retail landscape, brand building has emerged as a critical strategy for retailers aiming to establish themselves as industry leaders. In a recently published article, Coresight Research, a global data-driven research and advisory...