8 Ways Virtual Reality Shopper Research Is Transforming Retail Planning

For decades, shopper insights relied on physical mock stores, expensive prototypes, and slow in-person surveys or focus groups. Those methods still work, but they’re costly, limited, and often disconnected from the realities of today’s shopping experience.

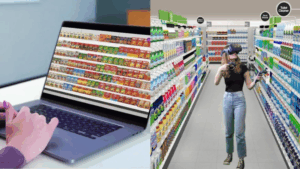

Today, top retailers and brands are moving their customer research into immersive, data-rich 3D environments. Virtual reality (VR) allows teams to observe authentic shopper behavior, test ideas faster, and directly link research insights to smarter assortment and space planning decisions.

From planogram testing to pricing studies, VR market research offers powerful applications that help retailers make smarter, faster store planning decisions.

Test Shelf Layouts and Assortments Fast

With VR, visual merchandisers can design, rearrange, and test shelf layouts in realistic 3D store environments. Instead of building physical prototypes, teams can virtually experiment with different assortments and facings while capturing behavioral data on what truly attracts shopper attention.

These shopper insights help retailers refine assortment strategies before rollout, minimizing the risk of poor planogram performance.

Validate Displays and Signage Before Rollout

Retail displays and in-store signage are high-cost, high-impact elements of visual merchandising — and often where sales are won or lost.

VR shopper research allows merchandising teams to build and test these displays virtually. Whether it’s a new endcap, a holiday feature, or updated in-aisle signage, retailers can gauge visibility, clarity, and shopper response in a controlled 3D environment.

This helps teams collect real customer feedback before anything is printed or shipped, ensuring only the best ideas make it to stores.

Evaluate New Product Concepts Virtually

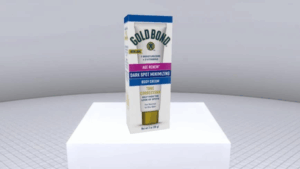

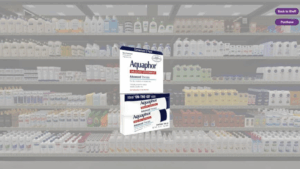

Instead of relying solely on focus groups or physical prototypes, virtual reality market testing lets retailers and brands introduce new products in life-size virtual environments. Participants can explore packaging, positioning, and pricing options in context. This delivers data that’s both faster and more realistic than traditional methods.

By testing new products in VR before production, visual merchandising teams reduce development costs, improve time-to-market, and ensure each innovation fits seamlessly within the store experience.

Refine Packaging Design for Visibility and Appeal

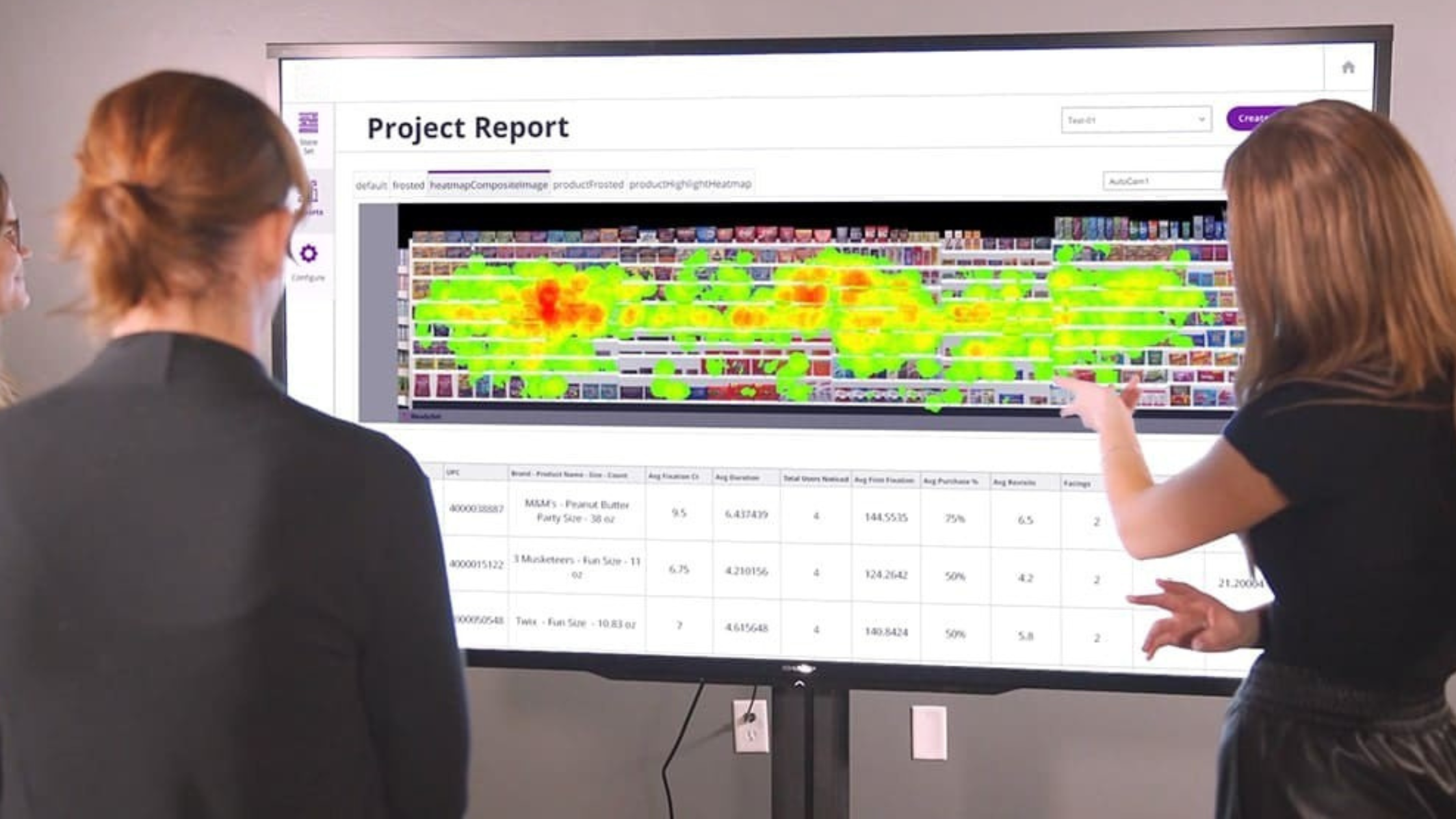

Shelf visibility can make or break a product launch. With VR’s eye-tracking capabilities, retailers can see exactly what shoppers notice first and what gets overlooked.

These studies reveal which design elements stand out under real shelf conditions, helping retail marketers and brand teams refine colors, messaging, and positioning to improve visibility and conversion.

Simulate Pricing Scenarios with Real Shopper Behavior

Finding the right price point is part art, part science — and VR brings both together by simulating pricing variations and promotions while measuring shopper reactions in real time.

This approach helps teams understand price sensitivity, test elasticity, and optimize promotions without costly live pilots. The result: Pricing strategies grounded in behavioral data, not assumptions.

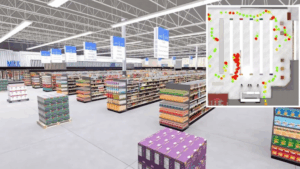

Analyze Customer Flow and Store Navigation

Understanding how shoppers move through a store is critical to optimizing layout and fixture placement. Virtual reality enables store planners to visualize foot traffic patterns, dwell times, and congestion points without the expense of building physical mock stores.

By analyzing where shoppers linger, turn, or abandon zones, store planners can design layouts that improve navigation, highlight key categories, and increase basket size.

Combine Quantitative Scale with Qualitative Depth

Traditional customer data often forces teams to choose between statistical scale and qualitative insight, but VR market research delivers both.

Using desktop-based virtual studies, retailers can collect large-scale quantitative data — tracking clicks, eye movement, and purchase decisions — while VR headsets enable immersive, qualitative sessions that uncover the “why” behind behavior.

Together, these digital approaches provide a complete picture of shopper motivation and decision-making, fueling better planning and design across the fleet.

Measure Front-End and Impulse Zone Performance

Checkout areas are some of the most valuable (and overlooked) spaces in retail. With virtual reality, retailers can test queue-line configurations, display placement, and impulse product visibility with life-like accuracy before investing in new fixtures.

Teams can simulate self-checkout and traditional lanes, tracking eye movement and dwell time to understand how shoppers engage with promotions and displays. These customer insights inform front-end layouts that improve traffic flow and drive incremental sales.

The Cost of Ignoring Visual Merchandising Insights

Poor visual merchandising doesn’t just create confusion; it costs retailers real revenue. The findings from shopper research show just how costly poor merchandising can be.

The Cost of Poor Visual Merchandising Report revealed that inadequate merchandising standards cost retailers over $125 billion in lost sales annually.

Download the report to uncover how shopper frustration, poor compliance, and disconnected planning translate to lost opportunities — and how data-driven planning and VR market research can help turn that around.